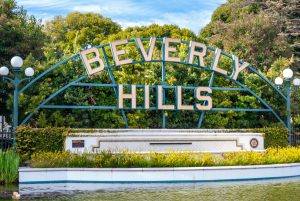

MEET BARRY DANTAGNAN

For over 30 years, accomplished Los Angeles real estate agent Barry Dantagnan’s business model has never wavered. With knowledge, honesty and effective communication as guiding principles, Barry has served countless buyers and sellers in many areas of Los Angeles, California. He has been honored with innumerable awards and holds steady as a top agent, but Barry’s true reward is the strong, personal bond he establishes with each client and the pride he takes in helping them achieve their real estate goals.

818.426.8677 | barrydantagnan@gmail.com | CalRE# 01020477